As Malaysia progresses towards its ambitious goal of achieving carbon neutrality by 2050, the government has introduced various incentives to encourage businesses and individuals to invest in green solutions. These incentives aim to promote renewable energy adoption, enhance energy efficiency, and support sustainable technologies across industries.

1. Green Technology Tax Incentives

Green Investment Tax Allowance (GITA)

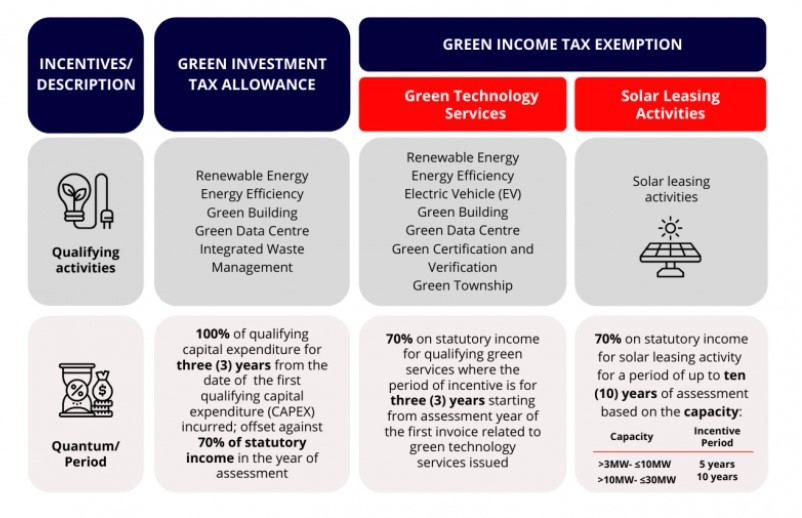

Companies investing in eligible green technology projects or assets can benefit from an investment tax allowance of 100% on capital expenditure, which can be deducted against 70% of their statutory income. This encourages businesses to incorporate sustainable solutions into their operations.

Green Income Tax Exemption (GITE)

To further incentivize the adoption of green technologies, companies providing qualified green technology services can enjoy a 100% income tax exemption on statutory income for up to five years. This initiative promotes the development of environmentally friendly solutions in industries such as energy efficiency, renewable energy, and sustainable waste management.

2. Green Technology Financing Scheme (GTFS)

The Green Technology Financing Scheme (GTFS) is designed to facilitate access to funding for businesses investing in green projects. Under this scheme:

- Companies receive a 2% per annum interest/profit rate subsidy for the first seven years.

- The government provides a 60% guarantee on the green component cost to financial institutions, reducing financial risks and improving credit access for green initiatives.

This scheme is crucial in supporting the growth of green businesses and accelerating Malaysia’s transition towards a low-carbon economy.

3. Investment Tax Allowance for Carbon Capture and Storage (CCS)

To encourage investment in carbon capture and storage technologies, the Malaysian government offers a 100% investment tax allowance on qualifying capital expenditures. This initiative aims to mitigate industrial carbon emissions and support the country’s sustainability commitments.

4. Solar Investment Tax Incentives

With Malaysia pushing for increased renewable energy adoption, businesses and individuals installing solar photovoltaic (PV) systems can take advantage of tax incentives. Under the GITA scheme, companies may offset up to 48% of the total investment cost of solar installations, making solar energy more financially viable for commercial and industrial applications.

5. Solar for Rakyat Incentive Scheme (SolaRIS)

To encourage residential solar adoption, Malaysia has launched the Solar for Rakyat Incentive Scheme (SolaRIS), which offers financial incentives to homeowners who install solar PV systems. This initiative aims to make renewable energy accessible to a wider population, reducing dependence on fossil fuels and lowering electricity costs for households.

Malaysia’s Commitment to a Greener Future

These incentives are part of Malaysia’s broader strategy to increase the share of renewable energy in its electricity generation to 70% by 2050. By promoting green investments and sustainable practices, the country is taking significant steps toward reducing carbon emissions, fostering energy independence, and building a more resilient economy.

For businesses and individuals looking to transition to sustainable energy solutions, now is the time to take advantage of these government-backed incentives and contribute to a cleaner, greener Malaysia.

For more INFO, may refer:-

https://www.myhijau.my/green-incentives/

This article is for informational and general interest purposes only and does not constitute tax advice.

#MIDA #MyHIJAU #SustainableFuture #ESG #SDG